Leading Advantages of Specialist Debt Management Plan Services for Debt Alleviation

Leading Advantages of Specialist Debt Management Plan Services for Debt Alleviation

Blog Article

Understanding the Importance of a Well-Structured Financial Debt Management Prepare For Financial Stability

As individuals navigate the complexities of handling their monetary responsibilities, a strategic method to financial obligation administration can pave the means for a much more safe and flourishing future. By understanding the fundamental principles and useful techniques behind effective debt management, individuals can unlock the course to not only lowering financial obligation problems however likewise cultivating a solid structure for lasting economic wellness.

The Effect of Financial Obligation on Financial Security

Furthermore, the effect of financial debt on economic security extends beyond simply the economic facets. It can also affect mental health, relationships, and general wellness. The tension and stress and anxiety related to overwhelming debt can hinder decision-making capabilities and strain specialist and personal partnerships.

Consequently, it is essential for organizations and people to carefully handle their financial debt degrees, making sure that it lines up with their financial goals and abilities. By understanding the effects of financial obligation on monetary stability and executing reliable financial debt management approaches, organizations and people can protect a more flourishing and stable financial future.

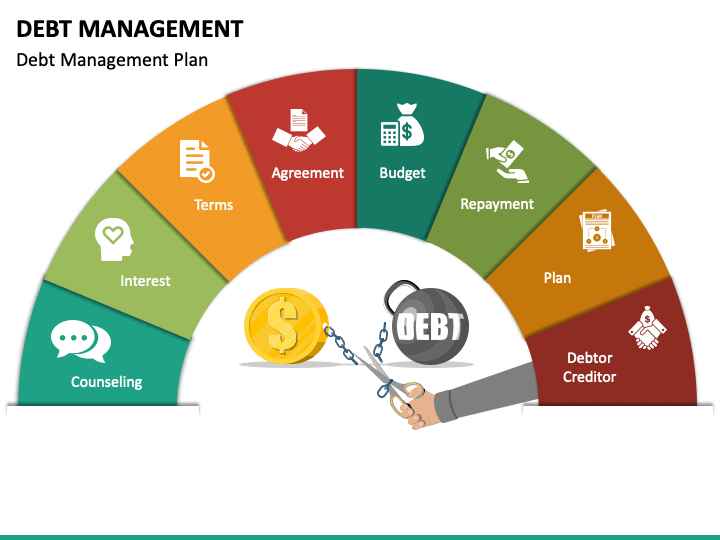

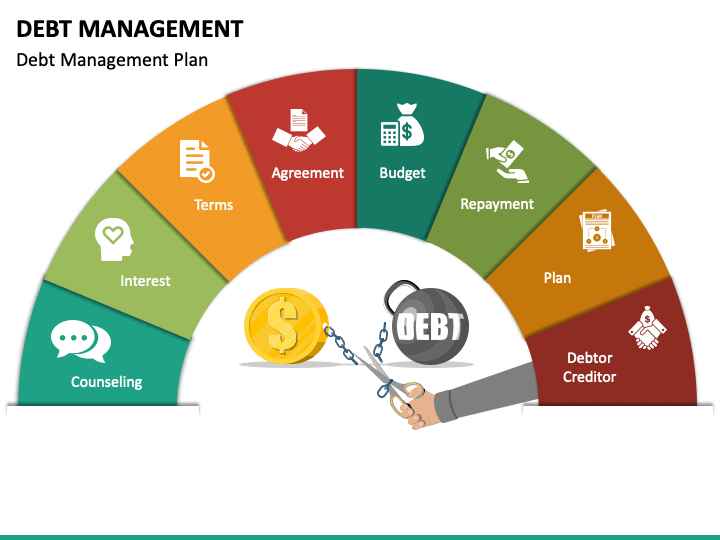

Elements of an Effective Financial Debt Administration Plan

Given the crucial importance of maintaining economic stability in the middle of varying financial debt levels, recognizing the vital parts of an efficient financial obligation administration strategy is paramount for people and organizations alike. An extensive financial obligation management plan commonly includes a complete assessment of current financial obligations, revenue, and costs to develop a clear economic image. Setting particular and attainable financial objectives is important in assisting the financial debt payment procedure. Focusing on financial debts based upon rate of interest, with a concentrate on settling high-interest debts initially, can save money in the future. Developing a comprehensive budget plan that designates funds for debt payment while still covering crucial expenditures is basic. Working out with lenders for reduced rates of interest or modified settlement strategies can additionally belong to a reliable debt management strategy. In addition, establishing an emergency fund to avoid building up more debt in situation of unexpected expenditures is a sensible part of a well-rounded debt monitoring strategy. Consistently monitoring and readjusting the strategy as needed ensures its effectiveness in achieving economic stability.

Advantages of Applying a Financial Debt Repayment Approach

Tips for Developing a Lasting Budget

Structure a solid monetary structure begins with grasping the art of developing a sustainable budget that lines up with your lasting monetary goals and matches your financial debt settlement method. To create a budget plan that promotes monetary security, start by tracking your income and expenses to understand your monetary patterns. Categorize your expenditures right into essential (such as real estate, energies, and groceries) and non-essential (like dining out and enjoyment) to focus on where your cash goes. Establish reasonable costs restrictions for each category, making certain that your vital costs are covered while leaving space for financial savings and financial obligation settlements.

Additionally, consider making use of budgeting devices and apps to streamline the process and maintain yourself answerable. Regularly review and adjust your spending plan as needed, specifically when confronted with unanticipated expenses or adjustments in earnings. Bear in mind to assign a section of your spending plan in the direction of constructing a reserve to cover unexpected economic difficulties. By complying with these tips and remaining disciplined in your budgeting method, you can create a lasting monetary plan that supports your lasting objectives and assists you achieve long-term financial stability.

Monitoring and Readjusting Your Debt Monitoring Plan

Consistently assessing and adapting your financial debt management plan is vital for keeping monetary progress and attaining financial obligation settlement goals. Checking your financial obligation monitoring strategy entails monitoring your income, costs, and financial debt equilibriums to ensure that you are staying on track with your economic goals (debt management plan services). By regularly evaluating your strategy, you can recognize any type of areas that may require adjustment, such as cutting down on unnecessary expenditures or raising your financial debt payments

Readjusting your financial debt administration plan might be required as your economic situation advances. Life modifications, such as a work loss or unanticipated costs, might need you to reassess your strategy and make modifications to suit these brand-new conditions. Furthermore, as you pay down your debt, you might discover that you have extra funds readily available to allot in the direction of financial obligation repayment or financial savings.

Verdict

To conclude, a well-structured financial view it now obligation administration strategy is necessary for preserving financial stability. By comprehending the impact of financial obligation, carrying out a settlement approach, developing a sustainable spending plan, and monitoring and changing the strategy as needed, individuals can take control of their monetary circumstance and job towards a debt-free future. It is crucial to focus on monetary wellness and make educated choices to safeguard a flourishing and steady monetary future.

By recognizing the fundamental principles and sensible methods behind reliable financial debt administration, individuals can unlock the course to not only lowering financial obligation concerns however likewise cultivating a solid foundation for long-term monetary wellness.

Given the essential importance of maintaining monetary security among varying financial debt levels, comprehending the necessary elements of a reliable financial obligation management plan is paramount for individuals and organizations alike. A detailed debt administration strategy normally includes an extensive evaluation of current financial debts, earnings, and costs to develop a clear monetary picture - debt management plan services.Consistently examining and adjusting your financial obligation administration strategy is crucial for maintaining financial progress and attaining debt repayment goals. Monitoring your financial debt administration plan entails keeping track of your income, expenses, you could try here and financial debt balances to make certain that you are staying on track with your financial purposes

Report this page